Facts About Invoice Factoring Revealed

Table of ContentsTop Guidelines Of Invoice FactoringInvoice Factoring for DummiesHow Invoice Factoring can Save You Time, Stress, and Money.Invoice Factoring Can Be Fun For Anyone

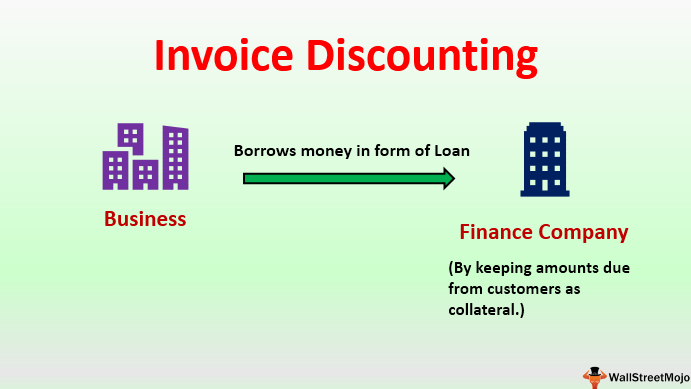

You may likewise refer Factoring as receivables factoring, billing factoring, and also occasionally incorrectly accounts receivable financing. Accounts receivable funding is a form of asset-based lending (ABL) utilizing a business's balance dues as security. The Factoring Process Your B2B or B2G company offers products or services to bigger creditworthy consumers and send correct invoices.

The factoring firm after that pays the equilibrium of the billing back to the B2B or B2G company minus a cost. When comprehending invoice factoring, it is vital to bear in mind that factoring varies from borrowing in companies sell balance dues rather than merely work as security. The internet outcome is that your business can convert its receivables into instant operating cash.

Non option factoring supplies the added advantage of protection against bankruptcy or personal bankruptcy. Only the very best, most experience factoring companies are able to offer non option to their consumers. This is particularly crucial in today's financial setting of uncertainty. Expect the unforeseen as business proprietors must be thorough in protecting their very own passions and source of incomes.

An Unbiased View of Invoice Factoring

Your service obtains the money it needs when it requires it, so you can best manage your business. invoice factoring. Billing factoring can be an outstanding alternative for firms that require money promptly yet who aren't able to protect a traditional financial institution finance. Lots of describe organization factoring by a number of names such as receivables factoring, billing discounting, billing factoring, and borrower funding.

Aspects will certainly intend to be certain that these companies have a history of paying their bills. The variable will additionally supply non-recourse factoring. Non-recourse protects your business when it comes to your customer going bankrupt during the purchase period. Completely understanding invoice factoring is a great way for firms to instill cash into their organization without tackling extra financial obligation.

Invoice factoring is often described as 'factoring', or 'debt factoring'. It is an economic item that makes it possible for businesses to offer unsettled invoices (accounts receivable) to a third-party factoring company (an aspect). The factoring business buys the billings for a percent of their total worth and then takes responsibility for collecting the invoice repayments.

The fundamental straight from the source actions are as complies with: You submit details of your invoices to the factor to identify if you are qualified for the factoring facility. The invoice factoring business will then evaluate exactly how high-risk they feel the financing is (this is sector details, in addition to concerning your certain customers) as well as will after that offer you their quote.

The Ultimate Guide To Invoice Factoring

The factor will certainly after that begin collection of the invoice with your customersOnce the invoice has actually been accumulated, the variable will pay you the staying equilibrium of your cash, minus their charge Summary After qualification is developed, the factoring firm will acquire the unpaid invoices for a percent of their value and then take over the financial obligation collection procedure.

In evaluating eligibility, factoring companies will take a look at a number of variables, consisting of: The dimension and origin of the invoices you're looking for repayment forTime framesPotential risksYour own companies credit report and also reputation This last factor to consider is less vital given that the actual danger for the element lies with the integrity of the business owing the superior invoice.

All About Invoice Factoring

Billing financing can be suitable for all new organizations, startups and even business with inadequate credit report, as a way of acquiring finance better. The prices might merely be somewhat higher, therefore for less well established services, or those with poor debt. Recap Yes. Any kind of organization can utilize billing factoring, yet it may only be suitable where invoices are taking 30-90+ days top article to make money, to assist with cash-flow.